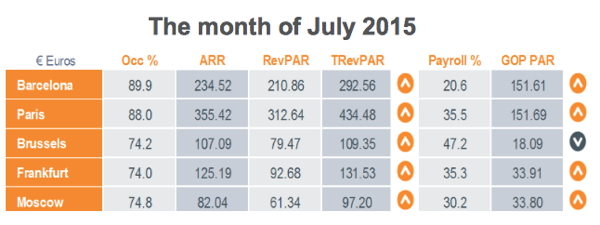

Both Barcelona and Paris hotels achieved noteworthy year-on-year increases in gross operating profit per available room (GOPPAR) in July by 24.9% and 16.6% respectively, according to the latest data from HotStats.

July was a strong month for Barcelona as the city registered an 18.5% increase in revenue per available room (RevPAR) thanks to a 1.5 percentage point uplift in occupancy combined with a 16.6% growth in average room rate (ARR). Further increases were reported in revenues per available room derived from food (+16.1%), beverage (+14.7%) and meeting room hire (+4.3%) which further supported the total revenue per available room (TRevPAR) growth of 17.1%. A decrease in payroll (-1.7 percentage points) resulted in departmental operating profit per available room (DOPPAR) rising by 21.8% to €198.64 leading to a GOPPAR growth of 24.9% to €151.61.

Hotels in the French capital simultaneously increased occupancy (+5.1 percentage points) and average room rate (+5.1%) to produce a RevPAR uplift of 11.6% in the month of July. ARR growth was most notably fueled by a 15.6% hike in the leisure segment rate to €413.89. Despite overheads per available room rising by 11.8%, an overall 2.1 percentage point decrease in payroll helped hoteliers produce the GOPPAR increase of 16.6%.

...Along with Frankfurt and Moscow

Demand in Frankfurt hotels increased by 2.8 percentage points during the month of July in addition to an ARR increase of 3.3%, leading to a RevPAR uplift of 7.3% to €92.68. TRevPAR levels also grew by 7.3% and payroll decreased marginally by 0.2 percentage points. Total food revenue per available room along with total beverage revenue per available room increased by 15.2% and 11.7%, respectively. As a result, DOPPAR increased by 8.8% and despite the 10.2% increase in overheads per available room, GOPPAR climbed by 7.2% to €33.91.

In July, Moscow hotels also increased occupancy by 7.5 percentage points but at the expense of ARR declining by 7.7%, and as a result RevPAR grew by 2.6%. A closer examination of the market segmentation showed rate reductions in the Best Available Rate sector (-17.8%), while the Corporate and Conference sectors increased by 26.5% and 55.4% respectively. In the meantime, hoteliers managed to control operating costs and recorded a reduction in overheads per available room of 3.5% altogether delivering a GOPPAR uplift of 13.6% to €33.80.

RevPAR up but profits down in Brussels

Hotels in Brussels experienced a challenging month of July despite a 2.8 percentage point increase in demand. The Brussels hotel market indicated once again that RevPAR alone can be a misleading indicator of hotel performance because despite the 5.4% rise for this metric there was a GOPPAR decrease of 13.0%. Although TRevPAR levels increased by 4.5% to €109.35 the payroll hike of 4.5 percentage points led to a DOPPAR decrease of 4.6% to €50.15 ultimately resulting in the GOPPAR decline of 13.0% to €18.09 compared to the same period last year.

Click here (![]() Adobe Acrobat PDF file) to download the complete report.

Adobe Acrobat PDF file) to download the complete report.

For an inside view of a local or regional market place in the hotel sector, bespoke HotStats reports are available. Terms and conditions apply. Visit www.hotstats.com to view a sample report.

HotStats provides two reporting tools to hoteliers:

Our unique profit and loss benchmarking service which enables monthly comparison of hotels’ performance against their competitors. It is distinguished by the fact that it provides in excess of 100 performance metric comparisons covering 70 areas of hotel revenue, cost, profit and statistics providing far deeper insight into the hotel operation than any other tool.

Our latest innovation in daily revenue intelligence, MORSE. Amongst its reporting are daily and highly granular market segmentation metrics as well as distribution channel and source of booking analysis. It takes daily market intelligence to a whole new level.

For more information contact:

Enquiries

+44 (0) 20 7892 2241

enquiries@hotstats.com