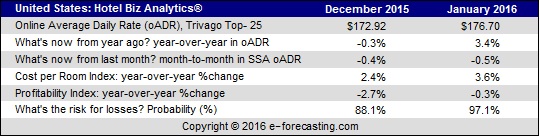

Hotel room rates in the top-25 most popular U.S. destinations are averaging $176.7 this January, up from $172.92 in December, according to trivago hotel price indices¹ (tHPI) released today. The U.S. online average daily rate (oADR), the industry’s best analytic for competitive pricing, currently ranges among the top-25 destinations from a high of $253 to a low of $118 this January. Based on industry surveys, e−forecasting.com estimates that in 2015 about 60% of all reservations are made online via brand websites and travel agent merchant websites, compared with only one-fourth eight years ago.

On year-over-year basis, the U.S. average online ADR is up (+3.4%) in January from a year ago, higher than the previous month's year-over-year growth rate of (−0.3%). This January, trivago online room rates in Miami after rising (+4.1%) from last year hit $253 a night, making the city the most expensive destination among the top-25 U.S. hotel markets. New York takes the second place in January with an online room rate of $228, after a drop of (−6.2%) from a year ago. In San Francisco, the online room rate in January is currently remaining the same as last year at $225 a night, ranking the city in the third place of the most expensive destinations in the United States.

At the bottom of the list, the three least expensive, or most affordable, cities to visit this January is Indianapolis recording a trivago online ADR of $124 a night after a (+5.1%) change from a year ago; St. Louis posts an online ADR of $122 following a (−3.2%) change from last year; and lastly, the most affordable popular destination in the country is San Antonio with an online ADR of $118 after a nil change from a year ago. With a median online ADR of $169 amongst the top-25 most popular U.S. destinations, Phoenix is the country's average affordable city to visit this January.

At the bottom of the list, the three least expensive, or most affordable, cities to visit this January is Indianapolis recording a trivago online ADR of $124 a night after a (+5.1%) change from a year ago; St. Louis posts an online ADR of $122 following a (−3.2%) change from last year; and lastly, the most affordable popular destination in the country is San Antonio with an online ADR of $118 after a nil change from a year ago. With a median online ADR of $169 amongst the top-25 most popular U.S. destinations, Phoenix is the country's average affordable city to visit this January.

Moving from data to hotel-biz-analytics®, e−forecasting.com's Smoothed Seasonally Adjusted (SSA)² U.S. average online room rate has hit $205.64 in January. On a month-over-month basis - the hoteliers' analytic for tracking changes of what's now vs. what's happened in comparison to twelve months ago - SSA online ADR this January is down (−0.5%) from the previous month, which is the same percent change as in the previous month. Looking at the top-25 hotel destinations, the month-to-month percent change in January ranges from a high of (+0.6%) in Miami to a low of (−2.6%) in Las Vegas. Amongst the top-25 destinations, the SSA online monthly room rate is growing in 8 cities; and is falling or staying flat in 17 cities.

"The latest US Monthly Hotel Forecast predicts profits per online room rates to advance on a year-over-year basis by 4% and 3.5% in the first and second quarters in 2016 respectively," said Maria Sogard, CEO of eforecasting.com. For more information on the full US Monthly Hotel Forecast with two-year predictions of occupancy, ADR, RevPAR, online ADR, costs per room, profitability and predictive analytics for investing in hotel properties, email us at info@e-forecasting.com with subject: USHOTfcast.

Looking at profitability, hoteliers' ultimate gauge for decision-making, profits per room are down (−0.3%) on a year-over-year basis in January, since U.S. trivago's average online room rate has gained (+3.4%) while e−forecasting.com national unit (per room) cost index is up (+3.6%). For U.S. hoteliers, year-over-year profit margins posted a reading of (−2.7%) in the previous month (December), compared to a mark of (+2.8%) a year ago (January 2015). Using trivago's online hotel room rates for the top-25 U.S. destinations and e−forecasting.com's city-centric hotel unit (room) cost indices, year-over-year percent change in profits per room currently range from a high of (+13.2%) in San Jose to a low of (−9.4%) in New York in January. Amongst the top-25 destinations, profits per room are up in 14 cities; they are down or are flat in 11 cities.

On tracking monthly the risk for business losses in providing services per room, the probability for U.S. hoteliers being in a negative profits (losses) phase of the industry's business cycle hit 97% in January, which is higher than December's reading of 88%. In the top-25 hotel destinations, the risk for hoteliers being in a period of losses per room in January ranging from a high of 100% in Seattle to a low of 6% in Las Vegas. The probability of losses per room is above 50% in 19 cities; it is 50% or below in 6 cities.

About e-forecasting.com

e-forecasting.com, an international economic research and consulting firm, offers forecasts of the economic environment using proprietary, real-time economic indicators to produce customized solutions for what’s next. e−forecasting.com collaborates with domestic and international clients and publications to provide timely economic content for use as predictive intelligence to strengthen its clients’ competitive advantage. For more information visit www.e-forecasting.com

About trivago

Founded in Düsseldorf in 2005 with operations in 39 countries, trivago is the world’s largest online hotel search site, comparing room rates from over 700,000 hotels on over 200 booking sites worldwide. Each month, more than 45 million visitors use trivago’s unique online technology, which compares 5 billion hotel deals a day - more than a trillion a year - and saves them an average of 35% per booking. Visit online http://www.trivago.com.