Top line growth fuelled a 27.4% year-on-year increase in profit per room at hotels in Barcelona this month as the city welcomed more than 11,000 delegates to the International Liver Congress (ILC), according to the latest data from HotStats.

Top line growth fuelled a 27.4% year-on-year increase in profit per room at hotels in Barcelona this month as the city welcomed more than 11,000 delegates to the International Liver Congress (ILC), according to the latest data from HotStats.

The ILC is the flagship event for the European Association for the Study of the Liver and this is the first time it has been hosted at the Fira Barcelona, having previously been held at the Reed Messe in Vienna in 2015.

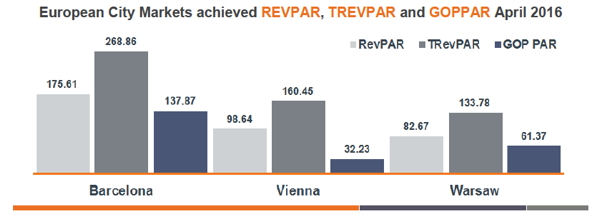

Hotels in Barcelona typically achieve strong room occupancy levels in the month of April, illustrated by the 79.6% recorded in 2015, as the city remains a hugely popular tourist destination and a key economic hub for Europe. And whilst the additional volume in the city contributed to a 1.9 percentage point increase in room occupancy, to 81.4%, it was the weight of demand which enabled hoteliers to significantly leverage average room rate to record a 13.1% year-on-year increase, to €215.69 from €190.63 in the same period in 2015.

The growth in rooms revenue, in addition to the increase in revenue derived from the food and beverage (+18.7%) and conference and banqueting (+31.6%) departments, on a per available room basis, contributed to a 16.5% increase in TrevPAR (Total Revenue per Available Room) for the month.

The strong April performance enabled hoteliers in Barcelona to continue their upward performance trajectory, with a profit per room increase of 9.1% recorded in the city in the rolling 12 months to April 2016.

Profit Plummets as Vienna Hotels Lament Loss of Liver Congress

Profit per room at hotels in Vienna declined by 29.3% in April as the nomadic ILC event and associated volume of delegates and subsequent revenue sources moved on to Barcelona.

Whilst the profit decline for the month is significant, it is as much a realignment towards previous performance levels than a concerning trend, with the city’s hoteliers recording a 62.1% year-on-year increase in GOPPAR (Gross Operating Profit per Available Room) when they hosted the event this time last year as it moved from London.

That said, Vienna does not benefit from the wealth of alternative demand sources enjoyed by other European capital cities and significant declines in achieved rate were recorded in the residential conference (-29.5%), corporate (-10.3%) and Best Available Rate (-17.3%) segments this month.

As a result of the 12.1% decline in achieved rate, RevPAR at hotels in Vienna fell by 16.2% to €98.64 in April, but remained well above the level recorded in April 2014, at €93.99.

More concerning for Vienna hoteliers, will be that the drop in performance this month contributed to the continued downward trajectory in profit per room since the turn of the year and as a result year-on-year GOPPAR has fallen by 26.0% in the first four months of 2016.

Warsaw Hotel Profit Performance Going from Strength to Strength

Hotels in Warsaw have had a particularly strong start to 2016, with the 39.9% year-on-year increase in profit per room recorded in April contributing to the year-to-date increase of 9.7%.

The year-to-date growth is further to the 6.0% increase in profit per room recorded in 2015 and has been primarily fuelled by the 9.4% increase in achieved average room rate, with the greatest margin of rate growth recorded in the leisure (+27.0%) and Best Available Rate (+13.6%) segments.

Room occupancy growth at hotels in the Polish capital in April has also been significant, at 8.2 percentage points for the month. This is in line with the increase in passenger numbers at Chopin Airport, which grew by 10% year-on-year to a record 932,000 passengers for the month, the nineteenth month of continuous growth in passenger numbers at the airport.

Click here (![]() Adobe Acrobat PDF file) to view full the report.

Adobe Acrobat PDF file) to view full the report.

For an inside view of a local or regional market place in the hotel sector, bespoke HotStats reports are available. Terms and conditions apply. Visit www.hotstats.com to view a sample report.

HotStats provides two reporting tools to hoteliers:

Our unique profit and loss benchmarking service which enables monthly comparison of hotels’ performance against their competitors. It is distinguished by the fact that it provides in excess of 100 performance metric comparisons covering 70 areas of hotel revenue, cost, profit and statistics providing far deeper insight into the hotel operation than any other tool.

Our latest innovation in daily revenue intelligence, MORSE. Amongst its reporting are daily and highly granular market segmentation metrics as well as distribution channel and source of booking analysis. It takes daily market intelligence to a whole new level.

For more information contact:

Enquiries

+44 (0) 20 7892 2241

enquiries@hotstats.com